Finding affordable, quality childcare is essential for many working parents. The current shortage of care options is helping drive up costs for parents across the nation. If you know you will be needing childcare coverage in the near future, here are some ways to plan for and manage this considerable expense of parenthood.

Know your options. Review available childcare arrangements and common hourly rates in your area.

- Relatives and sitters. Individuals who are not associated with a sitting service generally charge more modest rates for childcare. If you pay for services from a family member, tax rules do apply, though a bit differently if a grandparent provides the care.

- Nannies and au pairs. Hiring a nanny is often the most expensive childcare option. You’re paying for the convenience of a dedicated, in-home provider, but you may also need to fund room and board and make a car available for their use. A nanny-share arrangement can help reduce your cost for this form of care if you can get by with fewer hours of coverage or find someone willing to take on multiple children. Another option is to host an international au pair. Placed through an agency, this individual typically may provide up to 45 hours per week of in-home childcare in exchange for room and board, a weekly stipend and a modest education allowance.

- Daycare center. Centers tend to be more affordable than in-home help. While your children may not receive as much one-on-one time with a caretaker, daycare centers often provide a more social and educational environment.

- Co-ops. You might look into joining or creating a childcare co-op. In these arrangements, parents take turns watching each other’s children. This is a low-or no-cost option for families that have some flexibility in their work schedules or work opposite shifts.

Consider the tax implications. To help parents remain in the workforce, the federal government offers tax relief for a portion of eligible childcare costs.

- For the 2021 tax year, the American Rescue Plan Act allows eligible parents to claim a tax credit for 50% of up to $8,000 in childcare expenses, for up to two children (maximum credit of $8,000). Depending on your income, you may be able to reduce your tax bill or receive a cash refund of the eligible amount.

- If you are paying someone to care for your child in your home, you are considered a “household employer” and have the additional responsibility of paying employment taxes. The IRS usually does not impose this “nanny tax” if the childcare provider offers their services at their own home or place of business.

- Note that parents who pay cash for childcare services without reporting those payments cannot claim the tax exemption mentioned above and risk legal penalties.

Start saving. Any cushion you can provide your family before childcare costs kick in will be helpful. You’ll experience less pain when the time comes if you’re accustomed to accounting for this expense.

Get expert advice. A tax professional can help you realize the maximum tax relief associated with your childcare costs. Also consider meeting with a financial advisor to discuss this necessary expense impacts your short-and long-term savings goals. Together you can explore ways to improve your financial security as you watch your children grow.

###

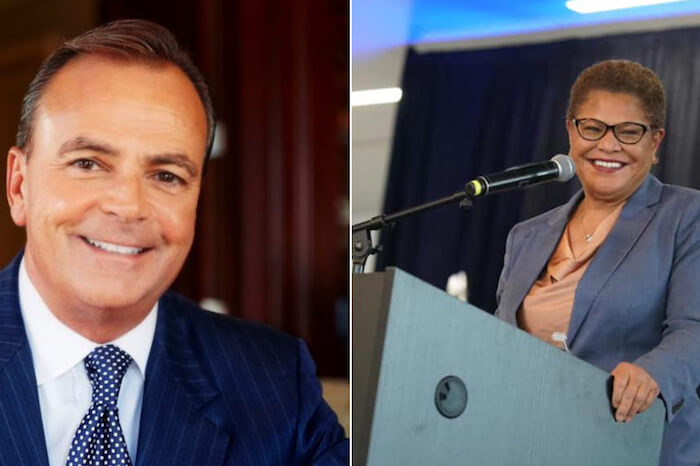

Anthony Perez, MBA, CFP® is a Private Wealth Advisor with Orchard Financial Group, a private wealth advisory practice of Ameriprise Financial Services, LLC. in Los Angeles, CA. He specializes in fee-based financial planning and asset management strategies and has been in practice for 19 years. To contact him, call 310.582.3500 | orchardfg.com | 12400 Wilshire Blvd, Suite 1210, Los Angeles, CA 90025.

Investment advisory products and services are made available through Ameriprise Financial Services, LLC, a registered investment adviser.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Ameriprise Financial and its affiliates do not offer tax or legal advice. Consumers should consult with their tax advisor or attorney regarding their specific situation.

Ameriprise Financial Services, LLC. Member FINRA and SIPC.

© 2022 Ameriprise Financial, Inc. All rights reserved.

File #3937671 (Approved until 03/2024)